The second in our series of posts on the growth of the global art market asks and answers questions about the factors fueling demand for contemporary art and record prices like the recent $179 MM Picasso sold at Christie’s.

Q: What explains the rising demand for contemporary art and the skyrocketing prices in the upper end of the market?

A: In addition to the reasons set forth in Part I, worldwide demand for art has been fueled by the growing wealth in emerging economies, the increase in the global population of the ultra-wealthy, and the building of new museums worldwide. Skyrocketing prices in the top tier of the market such as the $179 MM sale this week of Picasso’s 1955 painting “Les Femmes d’Alger (‘Version O’)” are driven primarily by the growing, albeit polarizing, number of uber-wealthy collectors in emerging and developed economies.

Significantly, there are more wealthy collectors in the world than ever before. According to the Billionaire Census conducted by Wealth-X and UBS, as of 2013, there were 2,170 billionaires in the world with total assets of $6.5 trillion. In 2013, according to Deloitte Luxembourg, the average billionaire allocated 1/2% or $31 MM of his/her wealth to art purchases; meaning that billionaire spending that year on art accounted for $32.6 B.

This means not only that more art work can be purchased, but also that there are more buyers who can pay higher prices. As Georgina Adam explains in her book, Big Bucks: The Explosion of the Art Market in the 21st Century¹: “Until the late 20th century, there were under 100 buyers in the world who could purchase major art works, those that fetched over $5MM.” In contrast, according to Ms. Adam, today it is estimated that there are over 1,000 buyers with that capability.

Those buyers come from established as well as emerging or oil rich economies such as China, India, Kazakhstan, Qatar and the United Arab Emirates. In China and India, buyers are comprised not only of the wealthy, but also of the growing middle classes that are willing to spend money on art.

Finally, according to Adam, demand for art has been increased by the explosion of so many new art museums (including private museums known as “vanity museums” created to house the personal collections of the ultra-wealthy) around the world, including the Middle East.

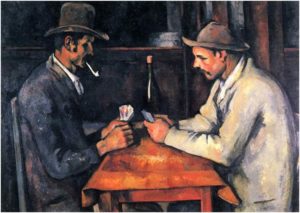

According to artnet news, the Qatar Museums reportedly spent $1B on art acquisitions and commissions in 2013, including the record $250 MM spent on Cezanne’s “The Card Players” (1892-93) shown here.

Given this increasing global demand for visual art and our mission to support the vocation of the living artist, Windows to the Divine is committed to providing artists and collectors the opportunities online and through our events to strategize and learn more about the global market in order to increase art collecting and appreciation.

¹ Adam, Georgina (2014), Big Bucks: The Explosion of the Art Market in the 21st Century (ISBN 978-1-84822-159-8), UK: Lund Humphries.

Shannon Robinson is the curator and chairperson of the national exhibition Windows to the Divine and the national plein air event Altitude and Attitude. More about Shannon…